For many families, the transition from renting to owning a home is a goal that seems exceedingly difficult to reach in our region. Due to the affordable housing crisis and families having limited options, partnerships with organizations such as Habitat DC-NOVA act as vital resources for homeownership.

A recent report from the Harvard Joint Center for Housing Studies reveals that as of 2023, 22.6 million renter households spent more than 30% of their income on rent and utilities, with over half of them spending more than 50%. This growing affordability crisis underscores the urgent need for pathways to stable and affordable homeownership.

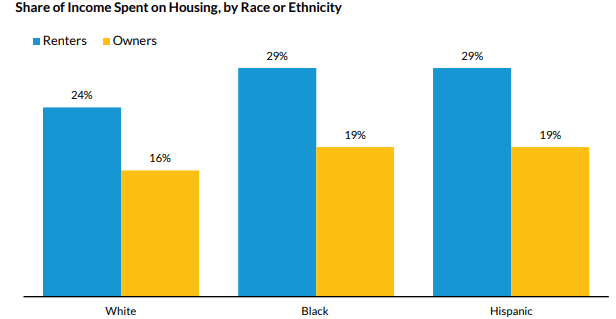

Costs are further affected by the race/ethnicity of the renter, with white renters having lower expense ratios overall.

The escalating affordability crisis

The affordability gap has widened over the past six decades. In 1960, the median renter household spent less than 20% of their income on rent. By 2022, that figure had risen to 31%, while median rents increased by 75%, and median renter incomes grew by just under 15%. This disparity has left many renters, especially those with lower incomes, in a cycle of financial strain.

The impact of stability

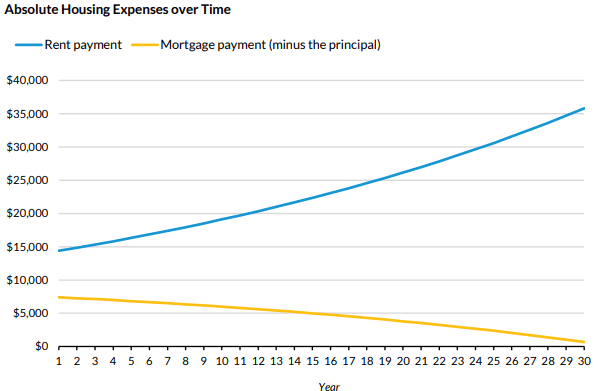

At Habitat DC-NOVA, we are aware that housing is more than just shelter. It’s also a foundational stepping stone to stability and a tool for building generational wealth. The majority of American homeowners have fixed-rate mortgages, while renters’ payments are subject to inflation. Owning a home offers greater financial positioning, as over time, housing-related costs decrease, while rent payments steadily increase instead.

When families begin their homeownership journey with Habitat, they’re often coming from overcrowded or unsafe rental conditions. Habitat works to provide not just a home but stability. That begins with financial education and personalized support. As families prepare for homeownership, they gain the necessary tools and confidence to manage their budgets, build upon prior financial knowledge, and envision a different future.

Stability brings immediate benefits: kids perform better in school, health outcomes improve, and parents can focus on long-term goals rather than short-term survival. Habitat for Humanity’s model is more than just building homes. Here are some points along the Habitat homeownership journey:

- Assessment and Support: Families apply based on need, ability to pay, and willingness to partner. Habitat provides coaching and education to prepare them for ownership.

- Affordable Mortgages: Habitat provides affordable mortgages, often lower than what families were paying in rent.

- Partnership: Clarity and communication help foster relationships in the Habitat homeownership journey. Families can speak with Habitat staff to learn about homeownership offerings and engage in other service offerings, both pre-application and during the approval process.

From renting to wealth creation

Homeownership is also about building equity. Every mortgage payment goes toward something a family owns. Over time, that equity becomes an asset that can be passed on, borrowed against, or simply provide peace of mind.

Studies consistently show that homeownership is a primary driver of wealth-building in the U.S., especially for low- and moderate-income families. By guiding families through the pipeline from renting to owning, Habitat DC-NOVA transforms housing from a monthly expense into a lifelong investment.

At Habitat for Humanity, we believe that everyone deserves a decent place to live. Homeownership creates stability. Stability creates opportunity. And opportunity creates wealth that can span generations. To view more affordable housing and rental assistance resources throughout D.C. and NOVA, click here.