Homeownership acts as a cornerstone of financial stability and wealth accumulation. For low-income families, owning a home can significantly enhance their ability to build equity and secure a stable financial future. Research has shown that U.S. homeowners have an average net wealth 400% higher than renters with similar demographics. This stark difference underscores the transformative impact of homeownership on an individual’s financial well-being.

The largest source of wealth for U.S. households, at 34.5%, is home equity. By investing in a home, low-income families can create a solid financial foundation that will continue to benefit and serve future generations. This long-term investment is essential for breaking the cycle of poverty and providing a stable environment for families to thrive.

Generational wealth

Generational wealth refers to the assets passed down from one generation to the next, and homeownership is a critical component of this legacy. Each year spent as a homeowner can increase net worth by approximately $9,500, making it a pivotal investment for financial stability. As property values rise over time, homeowners build significant equity, which can be leveraged for various purposes, including funding education, starting a business, or investing in other assets.

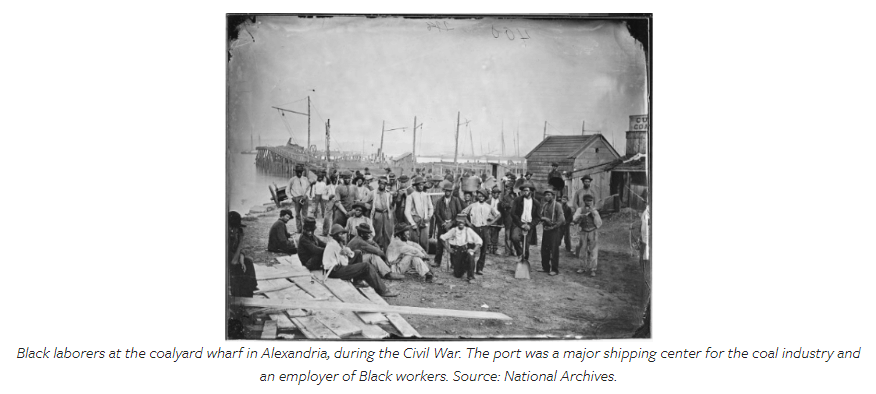

Historical evidence highlights the struggles for success faced by many across racial and socioeconomic intersections. Many examples of generational wealth and racial dynamics can be observed in our local area as well. Historically, white families in affluent areas of Washington, D.C., and Northern Virginia have reaped the benefits of inherited wealth to varying extents compared to other racial groups. While some individuals from high socioeconomic backgrounds rose from poverty, a significant portion were able to thrive due to advantages like property ownership, education, and other systemic supports afforded to their parents.

The struggles for success faced by many disadvantaged populations were created through deliberate efforts by those in power. The “islands of disadvantage” marking today’s maps stem from long-standing policies aimed at exclusion and segregation that marginalized communities of color.

The expansion of the wealth gap between communities was a direct result of societal structures often steeped in systemic racism that allowed wealth inequality to grow unchecked over time. Practices like redlining, restrictive covenants, and discriminatory zoning laws over the last century have affected housing equity among different socioeconomic and racial groups. This troubling cycle persists today, fueling the substantial wealth divide among racial groups.

The role of Habitat DC-NOVA in promoting homeownership

While the benefits of homeownership are clear, many low-income families face significant barriers in achieving this goal. High property prices, stringent loan requirements, and the challenge of saving for a down payment can make homeownership seem out of reach. However, affordable financing options and the ability to refinance loans at lower interest rates are crucial in maintaining homeownership. These financial tools enable buyers to effectively reduce costs and adapt to market fluctuations.

Habitat DC-NOVA is focused on promoting homeownership among low- and moderate-income households and dismantling obstacles preventing affordability. We support our local communities in accumulating meaningful home equity that enhances overall net wealth.

Beyond housing programs, Habitat provides a support system that includes financial literacy programs and home maintenance education. By addressing the unique challenges faced by low- and moderate-income families, we work to create a pathway to sustainable homeownership, thereby fostering generational wealth and economic stability.